Unemployment insurance (sometimes called unemployment benefits) is temporary financial assistance for unemployed individuals who meet certain requirements. Typically, you apply for unemployment in the state where you worked. Each state has its own unemployment program and its own requirements. Here is some basic information to figure out if you’re eligible for unemployment in Washington, DC, Maryland, or Virginia.

Is there a deadline to file for unemployment?

In DC, Maryland, and Virginia, there is no deadline. However, your eligibility depends on your previous employment. If you wait too long to apply, records from your previous job(s) may no longer be available. Also, you won’t receive back benefits for any time before you apply.

Does the reason I lost my job matter?

Yes. If you meet other requirements, you should be eligible if you and your employer agree that you were laid off or subject to a reduction in force (RIF) due to no fault of your own. However, you may not qualify if your employment ended because of another reason:

- Voluntary quit: In DC, MD, and VA, you won’t qualify if you voluntarily quit, resigned, or retired without good cause.

- Misconduct: In DC and Virginia, you won’t qualify if you were fired for misconduct. In Maryland, you are either disqualified or will receive less benefits depending on the type of misconduct.

You may still be eligible if your employment ended for another reason. For example, depending on the circumstances, you may qualify if you lost your job because you failed to perform or lacked the skills to do your job.

Do I have to earn a certain amount to qualify?

DC, Maryland, and Virginia use the same base period, which is a one-year period that includes the earliest four of five complete calendar quarters before the date you apply. For example, if you apply for benefits in April 2020, your base period is from January 1, 2019, through December 31, 2019. If you don’t qualify according to the base period, Maryland may use an alternate period to determine your eligibility.

In DC, you must meet all of the following requirements to qualify:

- You earned at least $1,300 in the highest paid quarter of the base period.

- Your total earnings for the base period are at least $1,950.

- You earned wages in at least two quarters of the base period.

- Your total earnings for the base period are at least 1.5 times your earnings in the highest paid quarter, or within $70 of that amount.

In Maryland, you must meet both of the following requirements:

- You earned at least $1,176 in the highest paid quarter of base period.

- Your total earnings for the base period are at least 1.5 times your earnings in the highest paid quarter.

In Virginia, you must meet both of the following requirements:

- Your earned wages in at least two quarters of the base period.

- Your total earnings for two quarters are at least $3,000.

How much will I get if I’m eligible for unemployment?

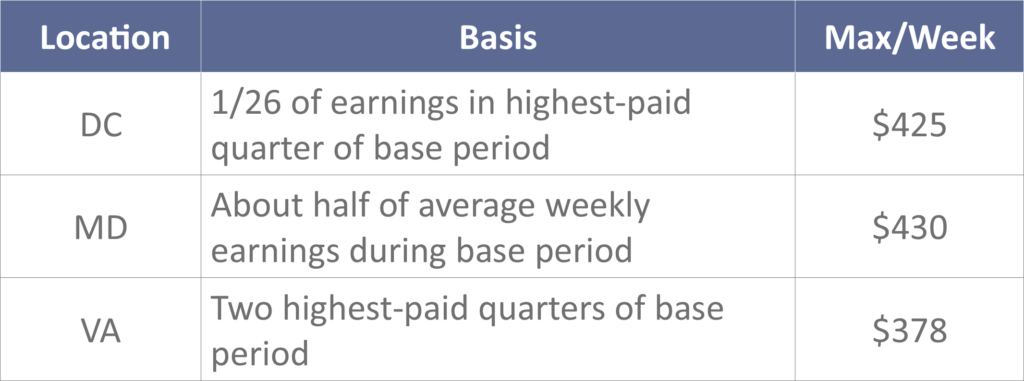

In DC, Maryland, and Virginia, you may receive a weekly benefit for up to 26 weeks. The weekly benefit amount varies by location:

What do I have to do to keep getting benefits?

After your claim is approved, you must meet requirements to continue receiving benefits:

- Be able, available, and willing to work;

- Accept any suitable job offer, unless you have good cause to decline;

- Report all earnings; and

- File weekly claims for benefits.

Additionally, each state has its own requirements for continued eligibility:

In DC, the requirements for continued eligibility include, but are not limited to:

- Registering with the District of Columbia Department of Employment Services (DOES);

- Registering for work through your local American Job Center;

- Contacting at least two employers each week to ask about jobs; and

- Keeping detailed written notes about the contacts.

Maryland’s requirements for continued eligibility include, but are not limited to:

- Actively searching for work based on your occupation and the labor market, and

- Keeping records of your job search.

In Virginia:

- Registering for VEC Workforce Connection within five days of applying for benefits;

- Actively searching for a new job; and

- Reporting the following on a weekly basis:

- All work you perform,

- All money you earn,

- The reason you were separated from any job, and

- Any job offer you declined.

Are there any exceptions for COVID-19?

In response to COVID-19, DC, Maryland, and Virginia have all made changes to their unemployment programs to expand benefits. Here is some basic information about the changes:

Washington, DC

DC’s COVID-19 Response Emergency Amendment Act of 2020 expands coverage for employees who are quarantined or isolated, or who are otherwise unemployed or partially-unemployed due to the pandemic. Visit the DC DOES website for helpful resources, including a chart to help you determine if you’re eligible for benefits during the pandemic and answers to frequently-asked questions.

Maryland

For the rest of the calendar year, Maryland’s Pandemic Unemployment Assistance program expands eligibility for affected workers affected by the pandemic:

- Up to 39 weeks of benefits;

- Eligibility for gig-workers, free lancers, independent contractors, and other self-employed workers;

- Temporary suspension of the work search requirement for continued eligibility.

For more information, check out Maryland Department of Labor’s answers to frequently-asked questions about unemployment benefits during the pandemic.

Virginia

Beginning with claims effective March 15, 2020, the Virginia Employment Commission is suspending both the one-week waiting period and the weekly job search requirement.

Visit the Virginia Employment Commission’s website for more information about filing coronavirus-related claims.

How can Alan Lescht and Associates help me?

If you need legal advice about your employment, Alan Lescht and Associates can help. Our attorneys will evaluate the facts of your case and advise you about your eligibility for unemployment benefits and ability to bring any other claims. Alan Lescht and Associates represents federal government employees around the world, and state and local government and private sector employees in DC, Maryland, and northern Virginia.